While there are a fair few personal finance apps out there. Emma and Yolt are two of the most popular money management apps right now. In this piece we are going to analyse and compare two of the biggest names in the space. We are comparing Yolt against the free version of Emma.

Onboarding

It’s hard to differentiate between the two when it comes to onboarding, both have two factor authentication. This means, when opening both apps for the first time you will have to create a password to enable access to your accounts. On top of this you have to enter a verification code. All in all, the onboarding experience for both Emma and Yolt is quick and simple enough without compromising security.

Winner - it’s a tie

What banks can they connect to?

Yolt connects to 40 bank accounts and Emma connects to 30.

Winner - Yolt

Home screen

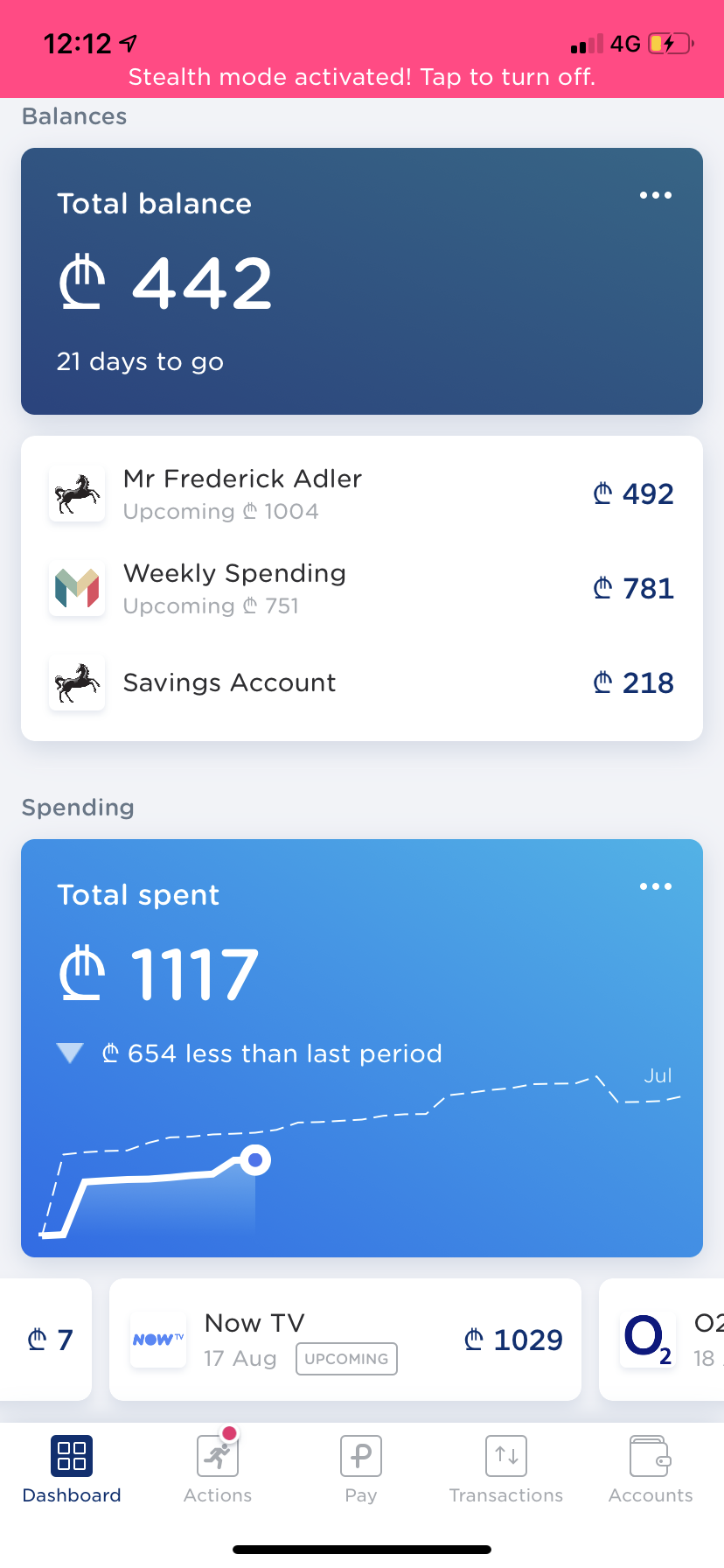

Yolt’s home screen opens up to a dashboard showing you all your accounts that you’ve connected to the app. As you scroll down you can see your total spend within a time frame that you yourself have picked. The problem with this feature is that generally people want to view their total spend from their payday to the next one, and with Yolt the total spend pay day tracker only works if you get paid monthly, or in a four week cycle. Those who are paid weekly or bi-weekly will not be able to use this feature.

Yolt’s dashboard also has a cool feature showcasing your upcoming subscriptions if you scroll to the right, and your previous payments if you scroll to the left. At the bottom of the dashboard you can view how much you have saved within a fixed time period.

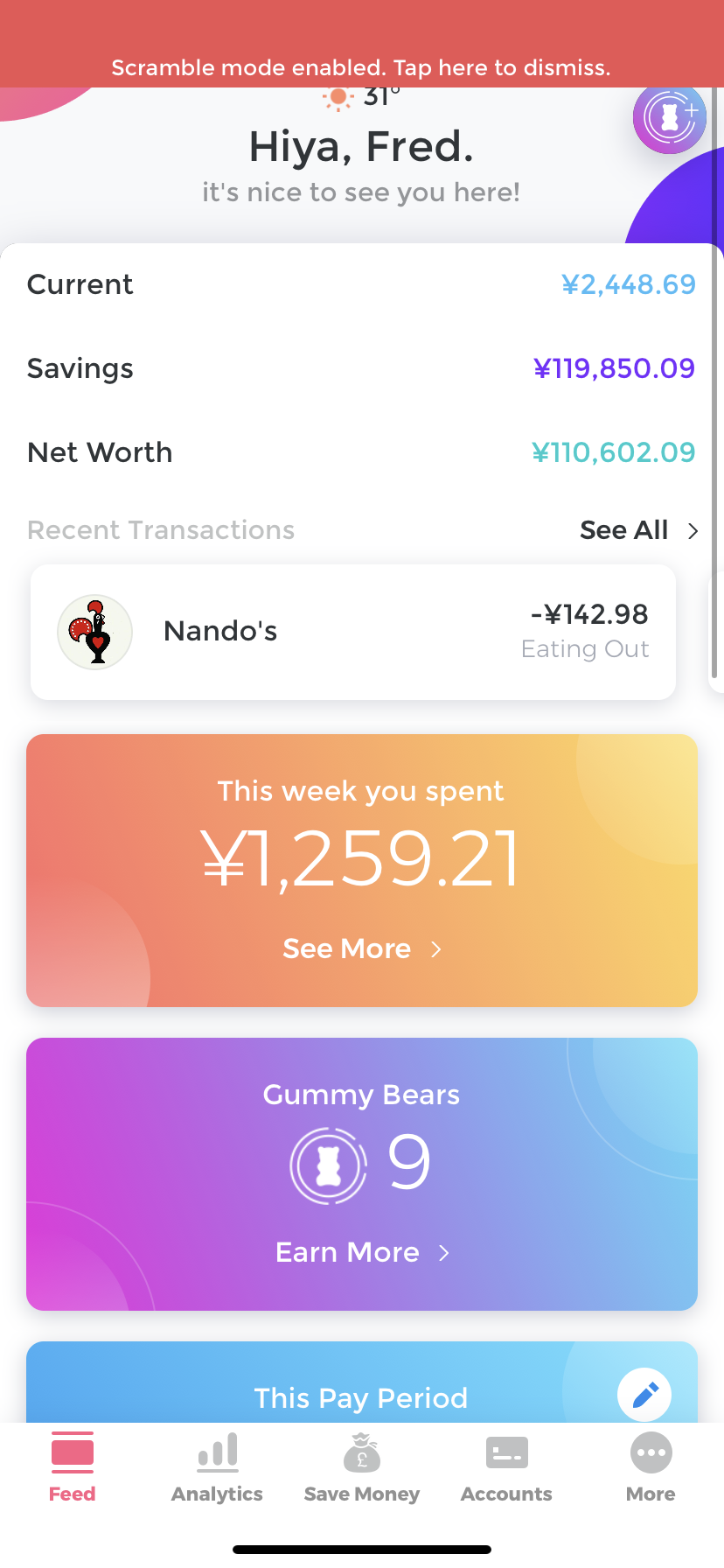

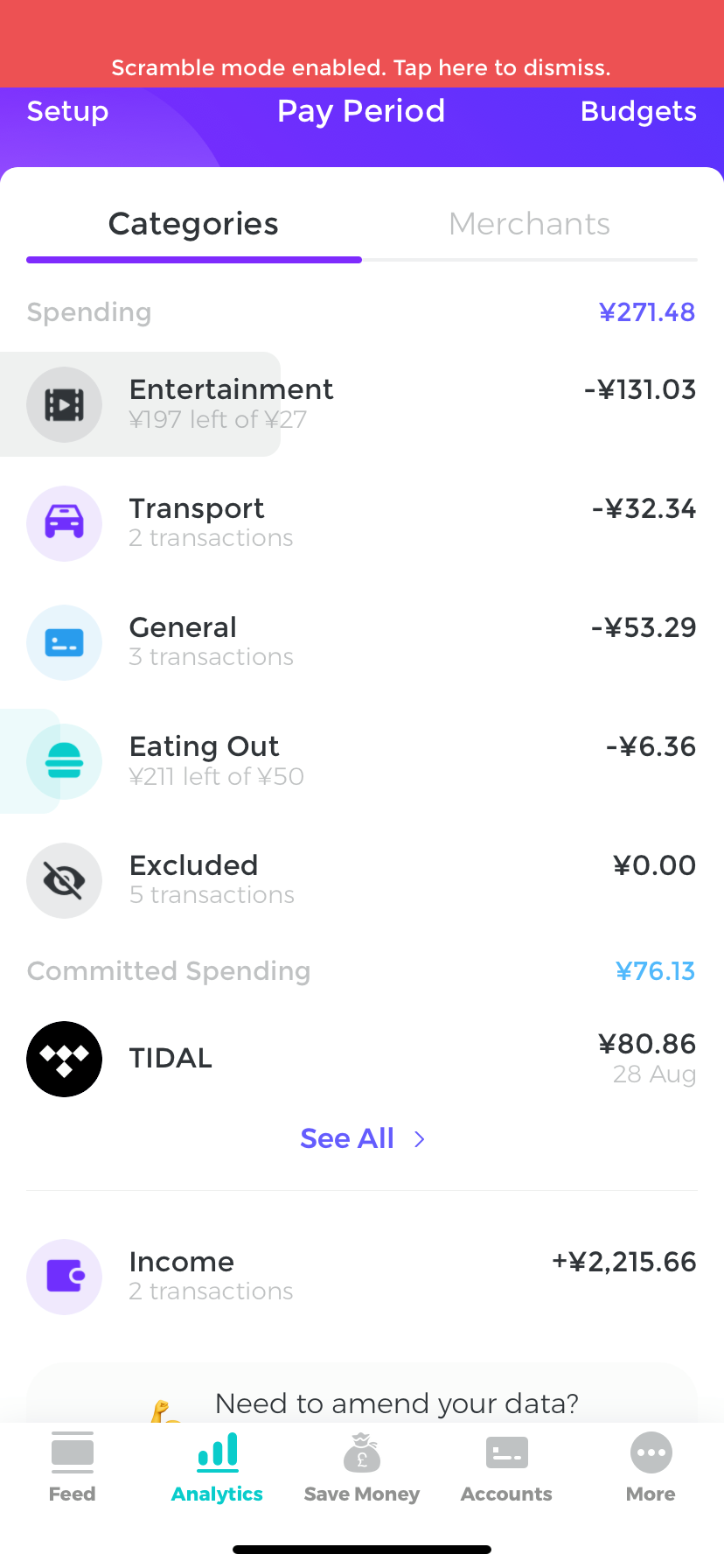

Emma’s home screen is considerably more vibrant. Much like Yolt, its dashboard opens up to a view of all your accounts, followed by your most recent transaction, and then the amount you have spent so far this week. A nice feature that Yolt doesn’t offer. Following this, Emma tells you how many ‘Gummy Bear’s you have, this is their version of a rewards point system, the more gummy bears you have the better the rewards you earn. You are given a gummy bear through daily logins , editing budgets and referring friends. As you carry on scrolling down the home screen you can find your total spend within a time frame you have personally set, the difference is there is no specific time frame you have to choose from. For example if you get paid on a weekly basis or bi monthly you can set that as a time frame and see how your spending is doing in relation to your unique payday. A neat little feature Emma offers within this pay period budget is your ‘committed spending’ insight, telling you how much you will be spending on subscriptions within the time line you have set.

Following this, you can see how long till your next pay day and below that a list of you upcoming subscriptions in chronological order. Overall I found Emma’s home screen to be more useful, while both apps share a lot of the same information with you, Emma gives you more specific insights without overwhelming you and it gives you more freedom with your payday to payday budget.

Winner - Emma

Transaction coverage and categorisation

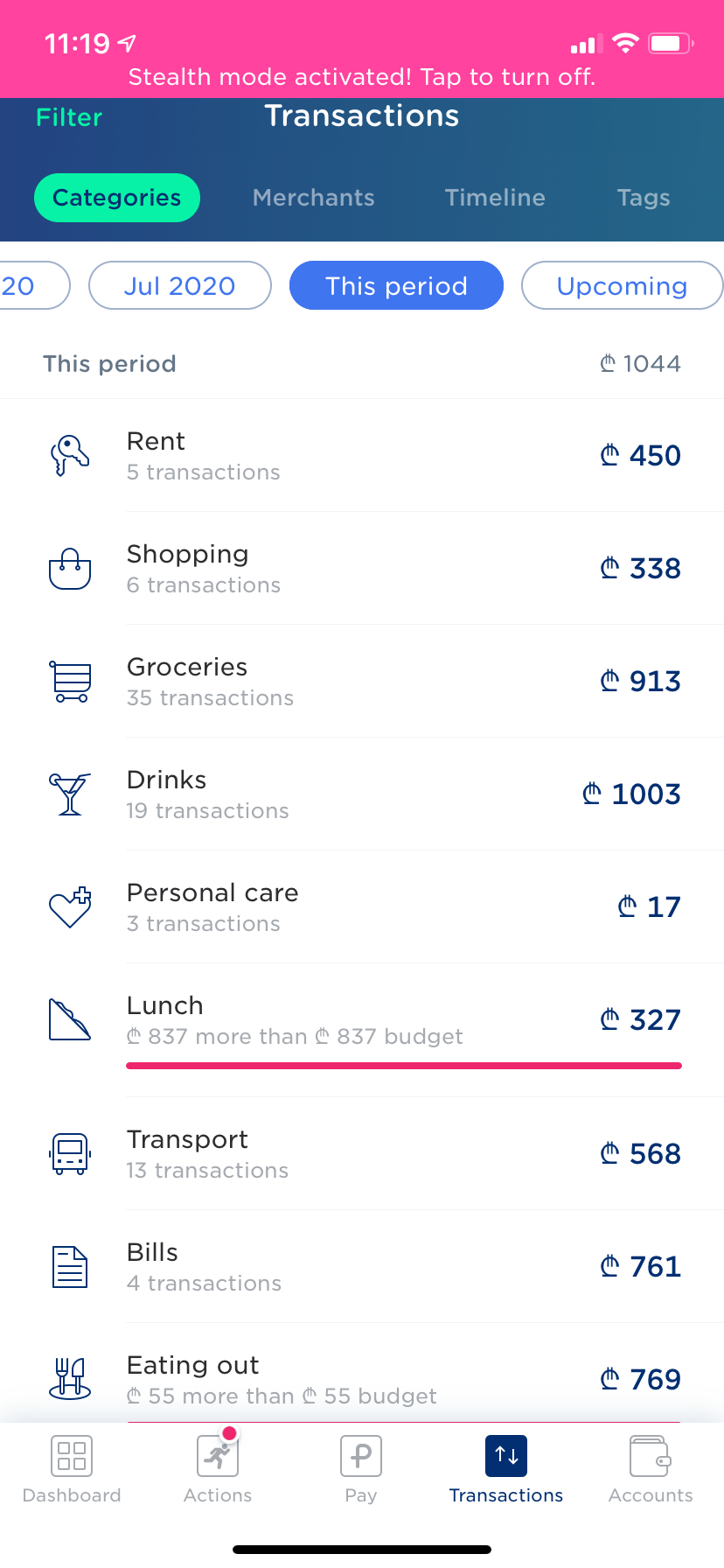

In terms of transaction coverage and budgeting by category, the two apps approach this in a very similar fashion. There is little difference between the two when it comes to these features. They both show you all of your transactions and you can budget by category easily with the two apps. For example if you wanted to set a monthly spending budget of £1100, with both apps you can then categorise how exactly that £1100 is split by setting specific spending caps on each category. So if you set a £60 a month budget on eating out, both apps will automatically tell you how much you have spent so far this month on eating out and how much money you have left in your eating out budget. Emma and Yolt both have a nifty feature where they will automatically categorise all your eating out transactions, so if you spent money at somewhere like Pret or Nando's both apps will put those transactions into your eating out budget without you lifting a finger. Their category coverage is pretty similar as well.

Winner - Tie

Making the most of your money

Both Emma and Yolt offer utility switching services to help save you money. Both companies have partnerships with Money Supermarket. They both offer similar comparison services to save money but neither one is better than the other. Services available on both apps include combining pensions, investing and insurance comparison.

Winner - Tie

Rewards

Both apps give you the opportunity to earn rewards, neither Emma or Yolt offer you anything too exciting. The best reward you get at Yolt is £25 off a purchase at Carphone Warehouse. Emma’s most impressive reward is 20% off your digital will. Neither offer you a real jaw dropping deal.

Winner - Tie

Pay within the app

This could have something to do with the fact that Yolt is a year older than Emma, but in regard to in app payment, Yolt offers it and Emma doesn’t.

Winner - Yolt

Weekly reports

Emma has a fantastic weekly report feature where it shows you how much you’ve spent and where. It does this in a friendly and informative way, showing you different styles of graphs and gifs to keep things entertaining. Yolt have their own version of a weekly report, it’s considerably shorter and less informative than Emma’s. Within Yolt’s weekly report they also asked me to open a PensionBee account through them which annoyed me because all I expected was information about my weekly spending, not an affiliate scheme.

Winner - Emma

Gamification

Emma has a feature called quests whereby you complete tasks to earn rewards, this is a cool idea and is a bit of fun. However, it is very much referral based. To earn any real rewards you need to refer a lot of people. No aspect of Yolt is gamified. Whilst the gamification is not for everyone I like that Emma offers the option.

Winner - Emma

Bank Fees

Emma has a feature where it tells you how much you have paid in bank fees, this is really useful information as bank fees can be pesky. This feature clearly lays out how much you have paid in fees to the banks you are with. I found out that I paid £50 in foreign transaction fees last year with my Lloyds account. This made me realise I need to just use my Monzo card when I’m paying abroad as they don’t charge any foreign fees! This is a useful service that benefited me and not one that Yolt offers.

Winner - Emma

Security

Both apps have bank level security measures meaning your information is guarded and protected using high level encryption. They both appear equally safe, there is little difference between the two.

Winner - Tie

Pricing

Yolt is an entirely free service and has made it clear it will stay that way. Emma has a premium service where they offer more features like custom categories, exporting of data and priority support. Emma Pro costs £9.99 a month.

Neither Yolt nor Emma claim to sell your data to third parties.

Conclusion

While Yolt and Emma share many similarities, all in all I found Emma to be the stand out app. Yolt has a more professional feel to it. Emma on the other hand, is more vibrant and youthful. I personally felt that Emma offered me more useful information and was easier to use. A big feature that swayed me to Emma’s corner, was the freedom to set a budget that interlinked with my unique payday. Both are great apps and you won’t go wrong using one or the other. I just thought Emma was more informative and simply more fun to use!